Introduction to Medicaid

Created in 1965, Medicaid is a public insurance program that provides health

coverage to low-income families and individuals, including children, parents, pregnant

women, seniors, and people with disabilities; it is funded jointly by the federal

government and the states. Each state operates its own Medicaid program within

federal guidelines. States have considerable flexibility in designing and administering

their programs, so eligibility and benefits vary widely from state to state.

Why Is Medicaid Important?

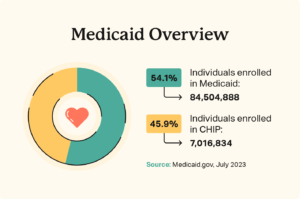

In 2018, Medicaid provided health coverage for 97 million low-income

Americans over the course of the year. In any given month, Medicaid

served 32 million children, 28 million adults (mostly in low-income

working families), 6 million seniors, and 9 million people with

disabilities, according to Congressional Budget Office (CBO) estimates.

Children account for more than two-fifths of Medicaid enrollees but only one-fifth of Medicaid spending. Only

one-fifth of Medicaid enrollees are seniors or people with disabilities, but because they need more (and

more costly) health care services, they account for nearly half of Medicaid spending.

Medicaid is sometimes confused with Medicare, the federally administered, federally funded health

insurance program for people over 65 and some people with disabilities. And there is overlap between the

two programs: nearly 10 million low-income seniors and people with disabilities — so-called “dual eligibles” —

are enrolled in both Medicare and Medicaid.

Medicaid is a counter-cyclical program: its enrollment expands to meet rising needs during an economic

downturn, when people lose their jobs and job-based health coverage. During the Great Recession of 2007-

09 and its aftermath, more than 10 million additional people — roughly half of them children — enrolled in

Medicaid. Likewise, Medicaid enrollment will rise in coming months due to the COVID-19 public health and

economic crises, preventing millions of people who lose jobs or income from becoming uninsured.

Who Is Eligible for Medicaid?

Medicaid is an “entitlement” program, which means that anyone who meets eligibility rules has a right to

enroll in Medicaid coverage. It also means that states have guaranteed federal financial support for part of

the cost of their Medicaid programs.

In order to receive federal funding, states must cover certain “mandatory” populations:

• children through age 18 in families with income below 138 percent of the federal poverty line

($29,974 for a family of three in 2020);

• people who are pregnant and have income below 138 percent of the poverty line;

• certain parents or caretakers with very low income; and

• most seniors and people with disabilities who receive cash assistance through the Supplemental

Security Income (SSI) program.

States may also receive federal Medicaid funds to cover “optional” populations. These include: people in the

groups listed above whose income exceeds the limits for “mandatory” coverage; seniors and people with

disabilities not receiving SSI and with income below the poverty line; “medically needy” people (those whose

income exceeds the state’s regular Medicaid eligibility limit but who have high medical expenses, such as for

nursing home care, that reduce their disposable income below the eligibility limit) and other people with

higher income who need long-term services and supports; and — thanks to the Affordable Care Act (ACA) —

non-disabled adults with income below 138 percent of the poverty line, including those without children. The

ACA was intended to extend coverage to all such adults, but a 2012 Supreme Court decision gave states the

choice of whether to expand their programs.

Not all people with low-incomes are eligible for Medicaid. In the 15 states that have not implemented the

ACA Medicaid expansion (as of April 2020), adults over 21 are generally ineligible for Medicaid no matter

how low their incomes are unless they are pregnant, caring for children, elderly, or have a disability. And, in

the typical non-expansion state, even parents are ineligible if their income exceeds just 42 percent of the

poverty line ($9,122 for a family of three).

In addition, many people who are not U.S. citizens are ineligible for Medicaid despite having a lawful

immigration status. This group includes people with temporary protected status whom the federal

government has allowed to live in the country for humanitarian reasons and people granted temporary

permission to come to the United States for educational purposes, travel, or work in a variety of fields,

among others. Also, lawful permanent residents (often referred to as green card holders) cannot enroll in

Medicaid for the first five years, even if they meet all eligibility requirements. (States have the option to

extend eligibility to all lawfully present children and pregnant women without a five-year wait.)

How Did the Affordable Care Act Change Medicaid?

Medicaid plays an even more important role in insuring low-income Americans due to the Affordable Care

Act. As noted, the ACA provides coverage for poor and low-income adults by expanding eligibility for Medicaid

to 138 percent of the poverty line. As of April 2020, 35 states plus the District of Columbia have

implemented the Medicaid expansion to serve poor and low-income adults. By 2029, 14 million more lowincome adults will have enrolled in Medicaid and gained access to affordable comprehensive health

coverage due to the ACA, CBO estimates.The expansion is a very good financial deal for states. After picking up all expansion costs for the first three

years, the federal government now pays 90 percent of expansion costs on a permanent basis. And by greatly

reducing the number of uninsured, the expansion will save states and localities substantial sums on

uncompensated care for the uninsured. Some expansion states have also experienced savings in mental

health programs, criminal justice systems, and other budget areas.

What Services Does Medicaid Cover?

Federal rules require state Medicaid programs to cover certain

“mandatory” services, such as hospital and physician care, laboratory

and X-ray services, home health services, and nursing facility services

for adults. States are also required to provide a more comprehensive

set of services, known as the Early and Periodic Screening, Diagnostic,

and Treatment (EPSDT) benefit, for children under age 21.

States can — and all do — cover certain additional services as well. All

states cover prescription drugs, and most cover other common optional benefits include dental care, vision

services, hearing aids, and personal care services for frail seniors and people with disabilities. These

services, though considered “optional” because states are not required to provide them, are critical to

meeting the health needs of Medicaid beneficiaries.

About three-quarters of all Medicaid spending on services pays for acute-care services such as hospital care,

physician services, and prescription drugs; the rest pays for nursing home and other long-term care services

and supports. Medicaid covers more than 60 percent of all nursing home residents and roughly 50 percent

of costs for long-term care services and supports.

Medicaid does not provide health care directly. The large majority of Medicaid beneficiaries are covered

through private managed care plans. For others, state Medicaid programs pay hospitals, doctors, nursing

homes, and other health care providers for covered services that they deliver to eligible patients. (Health

care providers are not required to participate in Medicaid, and not all do.)

How Much Does Medicaid Cost? How Is It Financed?

Together, states and the federal government spent about $630 billion on Medicaid services in fiscal year

2018. State policies have a substantial impact on the amount the federal government spends on Medicaid,

not only because states are guaranteed federal Medicaid matching funds for the costs of covered services

furnished to eligible individuals, but also because states have broad discretion to determine who is eligible,

what services they will cover, and what they will pay for covered services, as discussed above The federal government contributes at least $1 in matching funds for

every $1 a state spends on Medicaid. The fixed percentage the federal

government pays, known as the “FMAP,” varies by state, with poorer

states receiving larger amounts for each dollar they spend than

wealthier states. In the poorest states, the federal government pays

73 percent of Medicaid service costs; the national average is between

57 and 60 percent. As noted above, the federal government pays an

enhanced 90 percent of service costs on a permanent basis for lowincome adults covered by the ACA Medicaid expansion.

Medicaid is a lean program. It costs Medicaid substantially less than private insurance to cover people of

similar health status. This is due primarily to Medicaid’s lower payment rates to providers and lower

administrative costs. Over the past decade, costs per beneficiary grew more slowly for Medicaid than for

employer-sponsored insurance. And through 2027, the Office of the Actuary at the Centers for Medicare &

Medicaid Services projects, spending per beneficiary will grow no more rapidly in Medicaid than in private

insurance

Disclamer

The information provided on StayInsureWithHaider is strictly for the public and cannot be used as professional advice. Though we do our best to make the content accurate and reliable, we neither give nor are we in any way responsible for any express or implied warranties about the completeness, accuracy, reliability, suitability or availability of the information on this website for any purpose.

Any reliance you place on such information is strictly at your own risk. StayInsureWithHaider does not offer any legal, financial, or insurance advice. To get advice that is relevant to you, please contact a licensed insurance professional or advisor.

We are not affiliated with any of the insurance companies and do not endorse or recommend any specific insurance product or service. The opinions expressed on this website are ours and may not be those of an insurance company.

This website is provided on an “as is” basis. Under no circumstances shall StayInsureWithHaider be liable for any loss or injury, including indirect or consequential loss or damage, arising from the use of this website or its contents.

By accessing our website, you agree to this disclaimer. Not to use our website if you disagree with any part of the following disclaimer.

If you have any questions or concerns about content published on this website, you can contact us.